Unearthing Hidden Gems: An Unconventional Approach to Value Investing

In the ever-evolving labyrinth of financial markets, value investing has remained a steadfast strategy for many. However, in an era marked by rapid technological advancements and market volatility, traditional methods may need reevaluation. This article delves into the innovative approach to value investing, exploring its historical roots, current trends, and real-world applications.

The Genesis of Value Investing

Value investing emerged during the Great Depression as a beacon of hope for investors navigating the turbulent financial landscape. The concept was popularized by Columbia Business School professors Benjamin Graham and David Dodd, who advocated for buying stocks at prices less than their intrinsic value. This approach has been adapted and refined over the decades, but the underlying principle remains the same: seeking undervalued investments that promise long-term returns.

Modern Value Investing: A New Perspective

In recent years, the traditional value investing method has faced criticism due to its perceived inability to adapt to modern market trends. Critics argue that the method’s focus on tangible assets and historical financial data overlooks the potential of innovative and disruptive businesses.

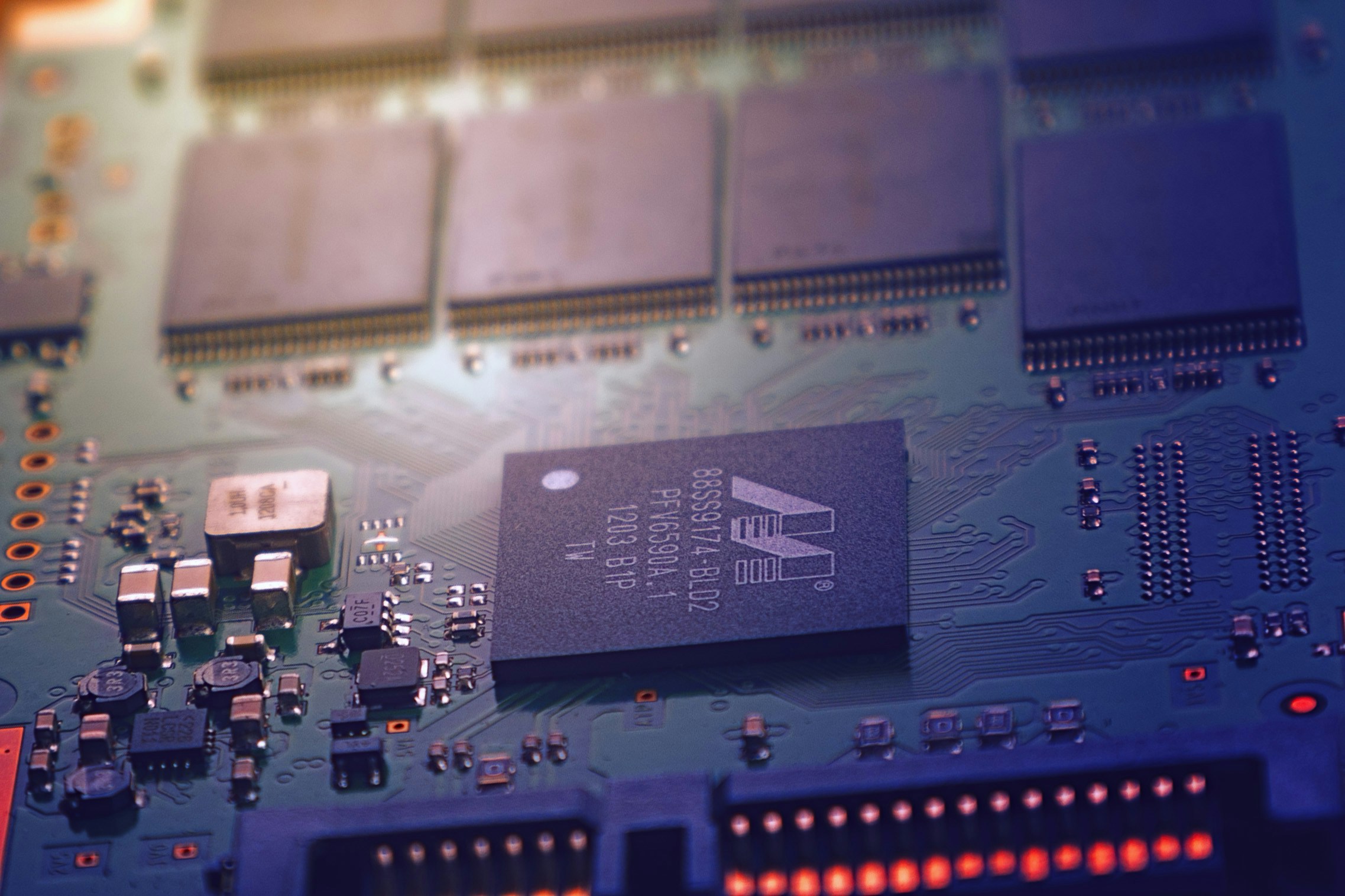

However, a new wave of value investors is challenging this view. They are integrating technology and data analytics into their strategies, identifying ‘hidden gem’ companies that may not meet traditional value criteria but offer promising growth potential. This modern approach to value investing considers factors such as disruptive business models, proprietary technology, and market dominance.

The Impact of Modern Value Investing: Benefits and Risks

The benefits of this modern approach are manifold. It allows investors to capitalize on the growth potential of innovative companies, which can lead to substantial returns. Moreover, it offers a more dynamic and adaptable investment strategy that aligns with the rapidly evolving business landscape.

However, this approach is not without risks. It requires a deep understanding of the technology and market trends driving these ‘hidden gems.’ Furthermore, it often involves investing in companies with high volatility, which can lead to substantial losses if not managed correctly.

Real-World Applications of Modern Value Investing

This unconventional approach to value investing is already being employed by some leading investment firms. For instance, ARK Investment Management, led by CEO Cathie Wood, is known for its emphasis on disruptive innovation. The firm’s approach, which integrates traditional value investing principles with a forward-thinking perspective, has led to impressive returns and a growing investor base.

Practical Insights

-

Embrace the evolution of value investing by integrating technology and market trends into your strategy.

-

Consider companies with disruptive business models and proprietary technology as potential value investments.

-

Be aware of the risks involved in this approach, including volatility and a requisite understanding of the technology and market trends.

-

Research and follow investment firms that are successfully employing this modern approach to value investing.

In conclusion, the landscape of value investing is undergoing a significant shift. The traditional approach, while still valid, may be enhanced by adapting to the evolving financial landscape. By embracing modern value investing strategies, investors can uncover ‘hidden gems’ and potentially achieve greater returns. This approach requires an understanding of technology and market trends, but for those willing to undertake the challenge, it offers an exciting new avenue for investment.